The autonomy and controllability of the semiconductor industry chain are gradually advancing upstream, and semiconductor components are expected to enter an explosive period of domestic substitution. Semiconductor components are located in the upstream of the chip manufacturing industry chain, accounting for nearly 90% of the operating costs of semiconductor equipment. The global market for semiconductor components reached approximately 386.1 billion yuan in 2022, with the Chinese mainland market accounting for 114.1 billion yuan in the same year. In recent years, countries such as the United States have attempted to restrict the advanced chip manufacturing capabilities of the Chinese mainland, shifting from limiting the export of advanced semiconductor equipment to the Chinese mainland over the past few years to including multiple domestic semiconductor equipment companies on the Entity List in December 2024. Enhancing the localization rate of semiconductor components is the most profound link in achieving autonomy and controllability of the industry chain, and there is still substantial room for domestic substitution in the high-endization of products.

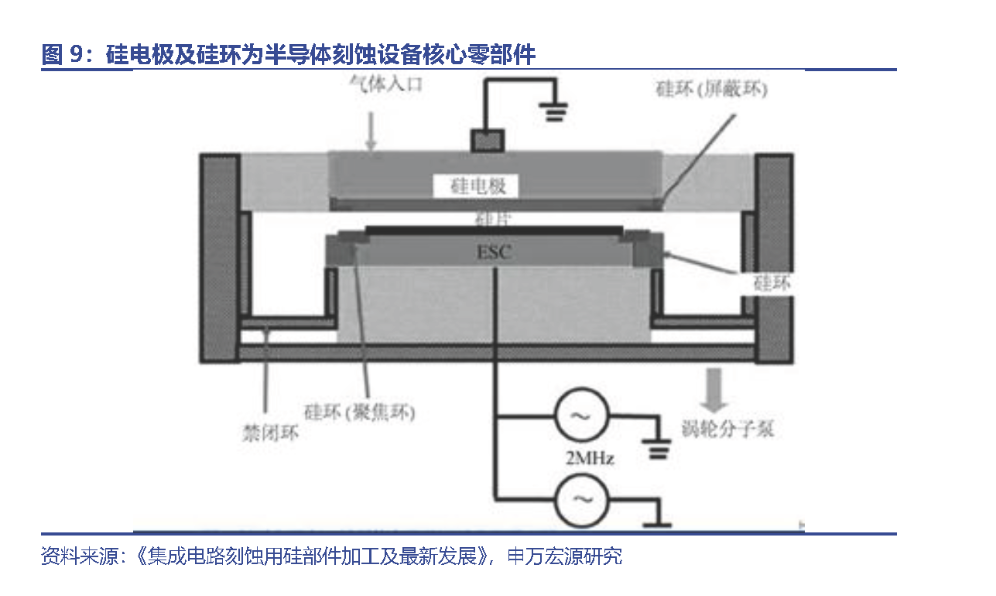

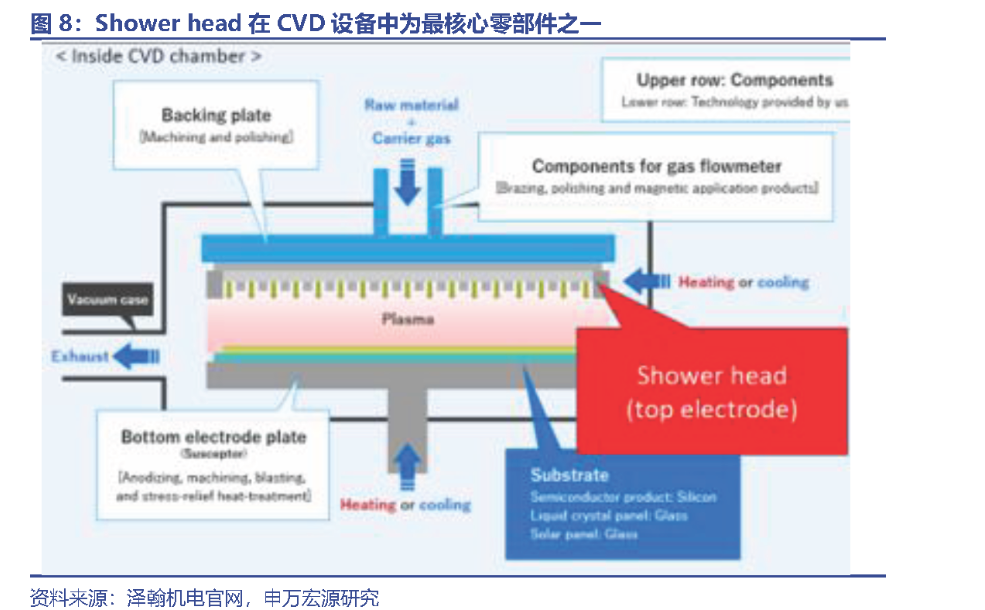

Mechanical Components: Widely used across all equipment, they are numerous in quantity and diverse in type, representing the largest market segment among semiconductor components. Mechanical components account for the highest value share, comprising 20-40% of equipment costs. With a vast array of product types, numbering in the tens of thousands, they find extensive applications in various segments of semiconductor equipment. Mechanical components can be categorized into process parts and structural parts based on their functions, and further divided into metallic and non-metallic types based on raw materials. Among the numerous categories of mechanical components, particular attention should be given to high-value, high-barrier-to-entry products such as showerheads, silicon electrodes, ceramic heaters, and electrostatic chucks.

Electrical Components: Focus on RF power supplies, which are high-tech-barrier key components in equipment such as etchers and thin-film deposition machines. RF power supplies provide fixed-frequency RF energy to semiconductor equipment chambers to ionize gases and generate plasma, making them one of the most critical components affecting the performance of etchers and thin-film deposition equipment, accounting for approximately 10-20% of the equipment cost. Given their relatively high technical complexity, the domestic market is still dominated by overseas manufacturers, with MKS (USA) as a representative, indicating significant potential for domestic substitution.

Electromechanical Integrated Components: Integrated modules and subsystems, mainly used for external auxiliary functions of semiconductor equipment. Electromechanical integrated components are generally modular products, with key products including EFEM (Equipment Front End Module), temperature controllers, and workpiece stages. EFEM is mainly used for automatic wafer supply and unloading in semiconductor equipment, loading (or unloading) wafers from the factory overhead crane system into (or out of) semiconductor equipment. Temperature controllers are used for temperature control of semiconductor equipment and are attached externally. Electromechanical integrated products have certain equipment attributes, with a higher proportion of direct sales to wafer fabs compared to other components.

Gas/Liquid/Vacuum Components: Systems and valves for controlling electronic specialty gases/liquids, with stringent performance requirements. Gas/liquid/vacuum components account for approximately 10-30% of equipment costs, primarily serving to transport and control specialty gases, liquids, and maintain vacuum in equipment. Key products include valve products and gas supply system components such as Gas Boxes. Gas Boxes are specialty process gas delivery and control devices, with high value and technical complexity. Vacuum valves are used to isolate or transmit media such as electronic gases outside vacuum areas, requiring excellent sealing performance and precise flow control.

Conclusion and Investment Analysis Opinion

We are optimistic about the development of the domestic semiconductor components industry, benefiting from the trend of domestic substitution. It is expected that the domestic semiconductor components market size will grow rapidly, with domestic component suppliers accelerating their market share gains, driving the expansion of domestic component companies' performance through both market space and share increases.

Reasons and Logic

Components account for approximately 90% of semiconductor equipment operating costs, with the market size expanding alongside semiconductor equipment. According to the financial reports of several A-share listed semiconductor equipment companies, about 90% of their operating costs are direct material costs, mainly semiconductor components. With semiconductor equipment companies generally achieving gross margins of 40-55%, the corresponding semiconductor components market is estimated to be approximately 40% of the semiconductor equipment market size. On the one hand, the semiconductor components market grows in tandem with the equipment market; on the other hand, market growth rate differences among equipment segments also affect the market potential of various component categories.

Industry chain security is becoming increasingly important, benefiting semiconductor components from the domestic substitution wave. In recent years, countries such as the United States have attempted to restrict the advanced chip manufacturing capabilities of the Chinese mainland, shifting from limiting the export of advanced semiconductor equipment to the Chinese mainland over the past few years to including multiple domestic semiconductor equipment companies on the Entity List in December 2024. Domestic wafer fabs have rapidly increased the localization rate of equipment and components for expansion in processes below 28nm, while also actively strengthening self-sufficiency in mature process areas to ensure supply chain security. Enhancing the localization rate of semiconductor components is the most profound link in achieving autonomy and controllability of the industry chain, with significant room for domestic substitution in product high-endization.

Semiconductor components have certain technical barriers, and domestic component manufacturers benefit from accelerated R&D through open validation by downstream customers. Compared to general mechanical equipment components, semiconductor equipment components typically have high precision, small batch sizes, multiple varieties, special sizes, complex processes, and high requirements, needing to balance composite functional requirements such as strength, strain, corrosion resistance, electronic characteristics, electromagnetic characteristics, and material purity, posing high technical challenges to manufacturers. Due to overseas trade restrictions, domestic semiconductor equipment companies and wafer fabs have adopted a more open attitude towards domestic component products, providing opportunities for product validation that accelerate the R&D of semiconductor components.

Different from Popular Perceptions

Some market investors believe that semiconductor components have low technical barriers and that the competitive landscape is prone to deterioration. We argue that high-end semiconductor component categories have high technical complexity, and customer resource differences also help enhance barriers. Key products such as electrostatic chucks, RF power supplies, and vacuum valves in semiconductor components have high technical complexity, with the domestic market still dominated by overseas enterprises such as those in the United States and Japan. After achieving technological breakthroughs in key products, domestic component manufacturers are expected to have certain barriers among domestic players and achieve rapid short-term market share gains. Additionally, the semiconductor manufacturing industry chain has high requirements for upstream product performance and stability, and once a stable supplier is formed, it is not easily switched. The component industry has high customer stickiness, and after domestic component manufacturers gradually complete domestic substitution, the competitive landscape is expected to stabilize.

AMTD provides high-precision Showerhead services for core components, with products mainly including Showerhead, Faceplate, Blocker Plate, Top Plate, Shield, Liner, Pumping Ring, Edge Ring, and other core components of semiconductor equipment. These products are widely used in the semiconductor, display panel, and other fields, with excellent performance and high market recognition.